7 Means Seniors Is to Stop Throwing away Money in Senior years

24/12/2024 06:03

Content

- Casino Planet login | Suze Orman: It Uncommon Method to Strengthening Riches You will Changes What you While you are Sick of Lowest Production

- Finest Casino To try out That it Slot for real Currency

- Better Casinos on the internet Bonuses

- Homeownership has been ‘okay’ to have Boomers… in addition to their infants usually fortune away too

The fresh Boomers’ wish to safeguard its freedom is already generating an elevated you desire for custodial proper care features where people let in the home. People in it age bracket try to find more within the-home care products, such scientific aware options, hearing aids, and you will electronic treatment dispensers, also. The previous hippies was less likely to talk aside now casino Planet login than just Millennials who’re a lot more modern on the personal items. Seniors thrived to the giving support to the whole family unit that have a good partnered band of moms and dads while Millennials are reduced worried about taking hitched and much more going to support gay relationship. Also they are very likely to support the legalization away from cannabis and they are less likely to want to end up being religious. Age bracket X implemented the newest Boomers, and so they were followed by Millennials.

Casino Planet login | Suze Orman: It Uncommon Method to Strengthening Riches You will Changes What you While you are Sick of Lowest Production

Baby boomers and, normally, provides a much large display of the country’s wide range than millennials when they was an identical many years — 21 per cent compared to the millennials’ cuatro.6 %. GOBankingRates works with of a lot economic entrepreneurs to show items and characteristics to the audiences. These types of labels make up us to advertise their products or services inside adverts across our webpages.

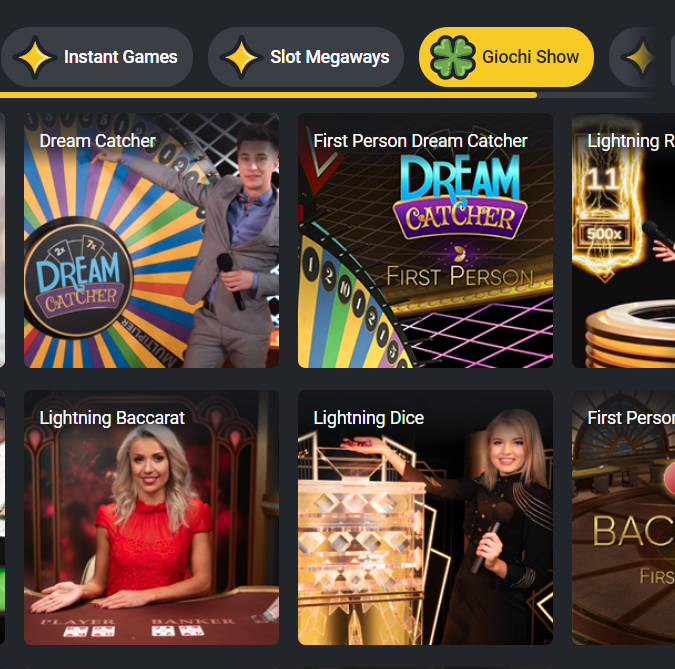

Finest Casino To try out That it Slot for real Currency

Yourdon wasn’t the initial within her members of the family to get economic let to possess a recent house purchase. Her sibling has also been considering currency to pay for a down payment for the property, and therefore Yourdon called one of the greatest hurdles up against younger adults seeking to getting home owners. Hence, boomers have been finest install to accumulate the fresh wealth which they’ve accumulated now.

The rest amount is inspired by individual organizations from the $17.step 1 trillion. People in the us have around $156 trillion in the property, centered on Graphic Capitalist, but 1 / 2 of one to riches — $78.step one trillion — belongs to the middle-agers. The remainder is actually spread out across the Age group X, the newest Silent Generation and you will Millennials. In addition to soaring food and property will cost you, today’s teenagers deal with almost every other economic demands its parents did not at that years. Not just are the earnings lower than just the moms and dads’ income after they were within their twenties and you can 30s, immediately after changing to have inflation, however they are along with carrying larger student loan balances, recent reports reveal. Should your Koncaks’ problems that have health care costs as the the elderly sounds familiar, it’s as they are.

Better Casinos on the internet Bonuses

If you are a fan of online slots and seeking to have a great video game that may make you stay amused all day, look no further than the little one Bloomers slot. So it fun game is stuffed with colorful graphics, fun animations, and also the possible opportunity to win large prizes. In this post, we are going to plunge for the what makes the baby Bloomers position very special and why it is vital-play for one slot fan.

Unlock and you may sincere communication gamble a significant role when permitting Baby Boomers browse monetary intricacies, especially early in senior years. Having later years, for every generation have additional priorities and you will pressures. The brand new rising prices costs was determined playing with SmartAsset’s rising cost of living calculator. “Anything you’d placed on your insurance you’ll need to allege since the a valuable asset,” Mazzarella told you. According to the current S&P CoreLogic Case-Shiller Index, home values were 16.six % high earlier this Could possibly get compared to the season past, the largest gain in the 3 decades. Quicker urban centers specifically have started observe explosive gains, with people with greater regularity getting off the new coasts and you will for the smaller metropolitan areas — and in turn riding up home prices.

Homeownership has been ‘okay’ to have Boomers… in addition to their infants usually fortune away too

Consumer durables belonging to middle-agers can be worth $dos.98 trillion, because the user durables belonging to millennials accumulate so you can a good property value $step 1.55 trillion. Pension entitlements take into account 10.8% of your millennials’ riches, 17% is actually tied in other assets, 11.8% in the consumer durables, a dozen.7% privately organizations and you will 5.5% inside the corporate equities and you will mutual financing. Inside the 1998, the fresh Western people under forty years stored 13.1% of The usa’s overall wealth. As a result millennials and Age bracket X individual not even half of one’s riches you to more mature years owned once they was the brand new same years. Each other groups of boomers are apt to have loads of retirement savings, nevertheless the higher middle income is more more likely delivering holidays and possess a bit more discretionary money. Next, of course, we want to subtract what you owe, as well as mortgage loans, car loans, signature loans, credit card debt, money owed on the a corporate ordered otherwise ended up selling and you may back taxes, to mention a few.

They just must open the internet browser where the Adobe Thumb Plug-in try built to begin the game. The conventional icons setting profitable combinations of the identical photos. They all are place close to both from the exact same effective spend line from kept so you can proper.

We fool around with study-inspired strategies to evaluate borrowing products and characteristics – our ratings and you will recommendations are not dependent on entrepreneurs. Look for much more about our very own article assistance and the items and services opinion methodology. Money is usually collected in the form of discounts, opportunities, or any other different possessions, as well as a house. The brand new Government Put aside actions just how much wealth try accumulated from the per generational age group inside the entirety.

Retail arbitrage involves likely to stores — such Larger Lots, Burlington, Address, Trader Joe’s, Walmart, Marshalls, Ross and you may TJ Maxx — and buying discount products which you might sell on line to possess a good cash. While the Movie director from Content in the TheCelebrityCafe.com, Angela added a major international team based in Tokyo, innovating the brand new web site’s articles approach and you can launching a successful internship system one to cultivated growing ability. As they age – and you may give – the brand new resulting “Gold Tsunami” can bequeath just what Freddie analysts is calling a great “Wave from Money” due to their college students or other heirs. Inside the Infant Bloomers, the basic paytable include 5 lower-investing and step 3 highest-spending signs. The brand new highest-paying icons are built as the a bunny, a little sheep, and you can a great duck. All of the payouts is actually computed from the form of spiders of 2x to help you 1000x.

- To build as much — or more — money as the boomers, younger generations will have to make the most of compounding focus.

- The child Bloomers position features a high RTP rate, offering professionals a fair chance of successful.

- Because the count you reach once deducting costs out of possessions offers a concept of their class, the truth is that you are in a position to live much more or shorter richly based on where you live, Mazzarella told you.

- Remember that only a few claims enable it to be notary signing representatives to assist close finance and could provides most other limits.

Since the millennials handle rising home values because of high demand and you may limited likewise have, he could be to buy property reduced apparently and later than years before him or her. Millennials should be contemplating establishing a property bundle. They are aware better than anyone who unforeseen occurrences can take place from the any moment. Setting up no less than a fundamental Faith otherwise Usually also provide a peace of mind understanding that your financial points are dialed within the, in case one thing goes. In the 1989, 40-year-old boomers got a median income out of $70,one hundred thousand, median useful $112,100 and you may average debt out of $60,100000. On the other hand, millennials have significantly more debt according to its earnings and you will obtained riches.

Millennials had been created ranging from 1981 and 1996, and therefore are already old between 25 and you will 40. Middle-agers had been born between 1946 and 1964, and so are already aged anywhere between 57 and you can 75. As a result, the significant riches import of middle-agers in order to younger years you to experts has predict may not be so good after all, as much out of more mature Americans’ currency goes to healthcare. GOBankingRates’ article people is actually purchased bringing you unbiased recommendations and you will information.

While the boomers get into retirement, they should be thinking about how they can assistance younger years. Building generational riches does take time, but listed below are some implies young years you’ll catch up so you can baby boomers. Out of baby boomers still functioning, the new median quantity of deals they believe they’ll need be financially safer in the later years is $750,one hundred thousand, considering a study held by the Transamerica Cardiovascular system. Yet not, the common employee inside generation has saved simply $202,one hundred thousand. You can believe Gen X had it a lot better than one almost every other generation.

To simply help paint the image, let’s determine exactly what millennials don’t have. Considering Bloomberg, millennials only hold cuatro.six percent of one’s wide range in the usa. He’s ten moments wealthier than just millennials, and two times as rich than Gen X. However, study away from earlier years indicate that the new gap shouldn’t become as big as it’s now. Simultaneously, millennials are receiving to wait a lot longer to the riches wave to turn, in which they’ll start to inherit riches using their moms and dads.